If they're required to file a 2019 tax return and they used the Non-Filer tool, this may delay processing their tax return and their Economic Impact Payment.

These individuals should wait two weeks after submitting their information.

Information is updated once a day, usually overnight, so there's no need to check it more than once a day.

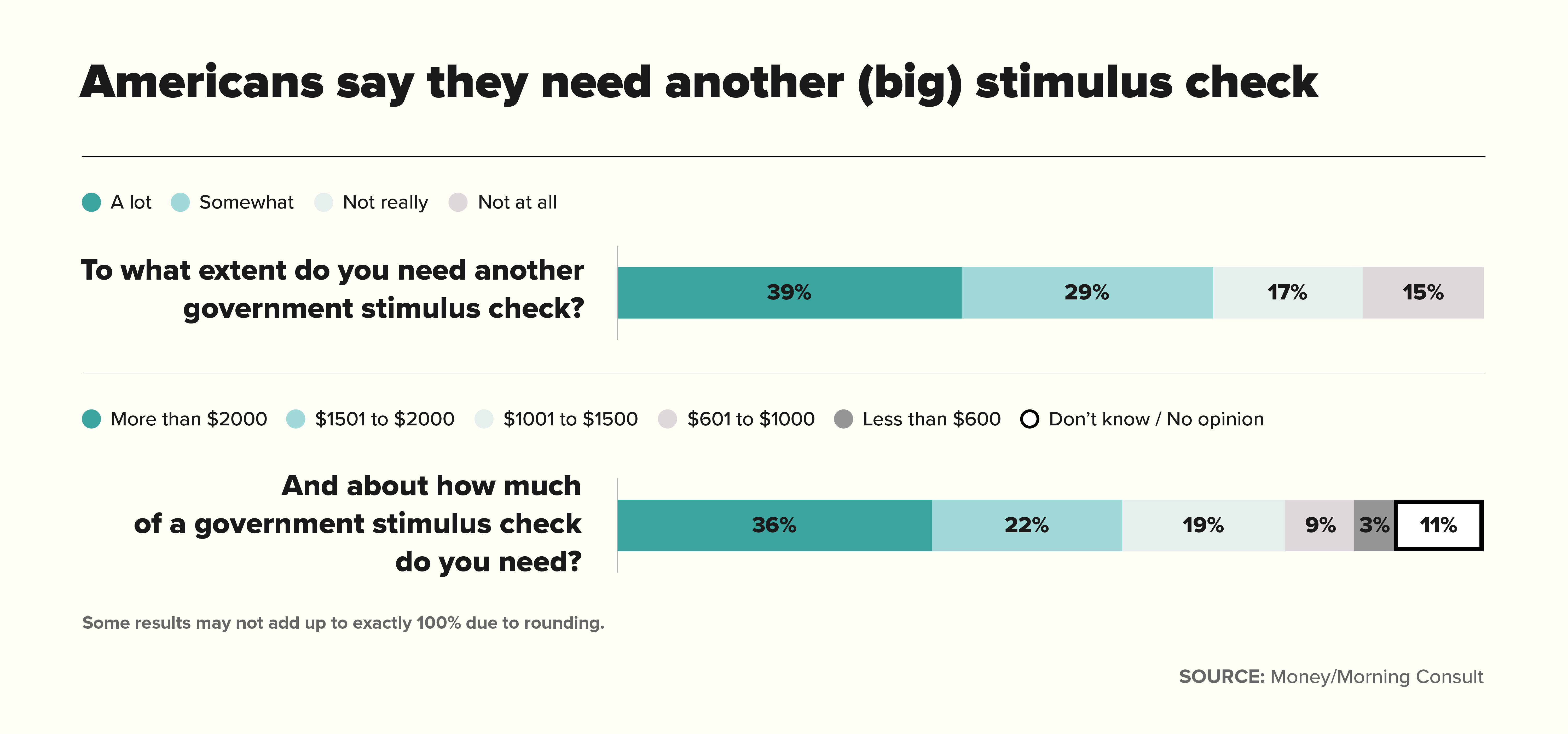

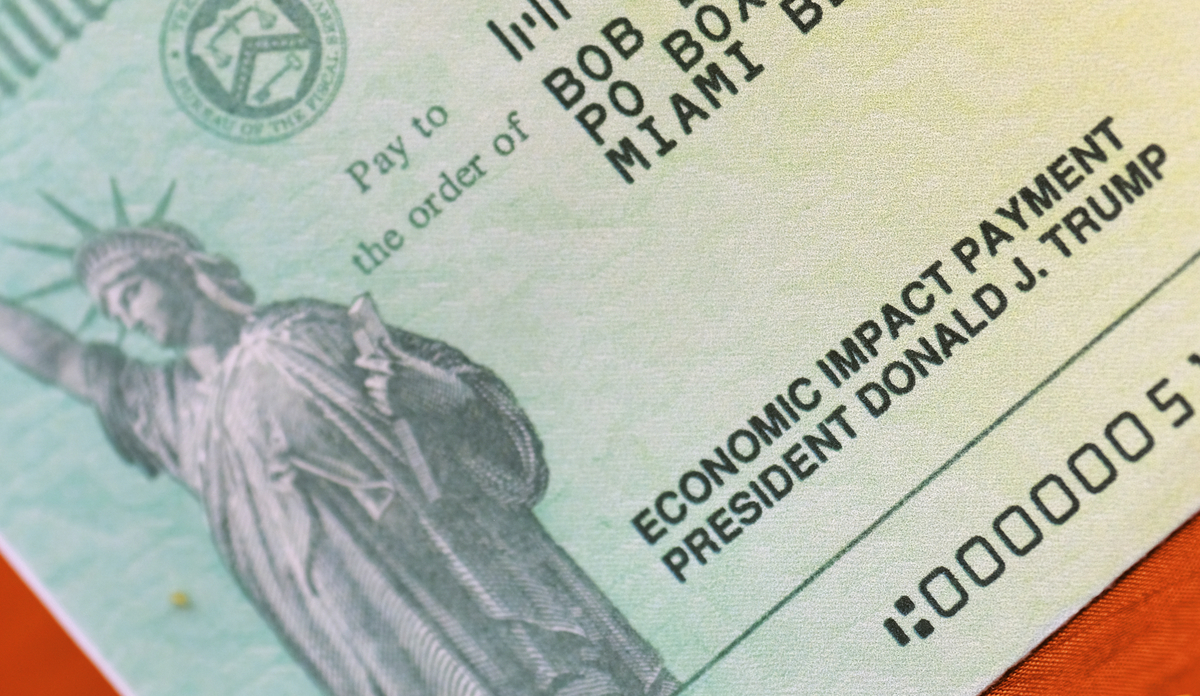

In certain situations, this tool will also give people the option of providing their bank account information to receive their payment by direct deposit. This tool will show if a payment has been issued and whether the payment was direct deposited or sent by mail. "However, the deadlines to do so are rapidly approaching.Find The Status of Your Economic Impact Payment Using The IRS Get My Payment ToolĮligible individuals can visit IRS.gov and use the Get My Payment tool to find out the status of their Economic Impact Payment. "Individuals who think they may be eligible but did not receive a COVID-19 payment in 2020 or 2021 or the CTC can file a simplified return at ," GAO wrote in its blog. had limited or no access to the internet.did not have a bank account or access to a bank.were in mixed immigrant status families.had never filed a tax return or were filing a tax return for the first time.GAO discovered that people within certain groups may have faced difficulty receiving their payments. Tax returns can also be completed and submitted through CTC's site, including the simplified filing tool which was updated on Wednesday. You can check the IRS's site to determine if you qualify. Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. The Child Tax Credit (CTC) was also temporarily extended by Congress to consider more families and increase how much they can receive. Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.įamilies can also receive $1,400 per dependent, regardless of the dependent's age.

0 kommentar(er)

0 kommentar(er)